美版拼夕夕每单亏损$30,每年亏损十亿美元,

版主: Softfist

美版拼夕夕每单亏损$30,每年亏损十亿美元,

https://www.wired.com/story/temu-is-los ... eap-socks/

Temu, owned by the Chinese tech giant PDD, has exploded onto the top of US app stores since it launched last September, targeting cash-strapped Americans with cheap unbranded products shipped directly from Guangzhou, China. In just seven months, Temu’s app has been downloaded 50 million times.

But the reason that prices on Temu seem impossibly low is that they are. An analysis of the company’s supply chain costs by WIRED—confirmed by a company insider—shows that Temu is losing an average of $30 per order as it throws money at trying to break into the American market. The financial company China Merchants Securities has calculated that Temu, which is also operating in Canada, Australia, and New Zealand, is losing between RMB 4.15 billion and RMB 6.73 billion ($588 million to $954 million) per year. At the same time, the company is squeezing small manufacturers in China, pressuring them to cut prices to levels that make it almost impossible to turn a profit

Temu, owned by the Chinese tech giant PDD, has exploded onto the top of US app stores since it launched last September, targeting cash-strapped Americans with cheap unbranded products shipped directly from Guangzhou, China. In just seven months, Temu’s app has been downloaded 50 million times.

But the reason that prices on Temu seem impossibly low is that they are. An analysis of the company’s supply chain costs by WIRED—confirmed by a company insider—shows that Temu is losing an average of $30 per order as it throws money at trying to break into the American market. The financial company China Merchants Securities has calculated that Temu, which is also operating in Canada, Australia, and New Zealand, is losing between RMB 4.15 billion and RMB 6.73 billion ($588 million to $954 million) per year. At the same time, the company is squeezing small manufacturers in China, pressuring them to cut prices to levels that make it almost impossible to turn a profit

Re: 美版拼夕夕每单亏损$30,每年亏损十亿美元,

书买过几个小东西

便宜是便宜

质量实在太差

感觉生活体验下降了一个档次

感觉不值

沃尔玛卖的虽然也是国货(现在越来越少了),好歹筛选过,而且质量控制得好些

便宜是便宜

质量实在太差

感觉生活体验下降了一个档次

感觉不值

沃尔玛卖的虽然也是国货(现在越来越少了),好歹筛选过,而且质量控制得好些

Re: 美版拼夕夕每单亏损$30,每年亏损十亿美元,

前段时间买了个豆浆机

60的东西放cart里很久

后来发邮件说可以20

然后上次发货晚到货晚给了10刀credit

最后10块买到

这么做生意不赔钱就奇怪了

60的东西放cart里很久

后来发邮件说可以20

然后上次发货晚到货晚给了10刀credit

最后10块买到

这么做生意不赔钱就奇怪了

Re: 美版拼夕夕每单亏损$30,每年亏损十亿美元,

亏钱再多不是个事。花街就认销售增长。过段时间把股票卖给韭菜就齐活了

willhung 写了: 2023年 5月 26日 07:59 https://www.wired.com/story/temu-is-los ... eap-socks/

Temu, owned by the Chinese tech giant PDD, has exploded onto the top of US app stores since it launched last September, targeting cash-strapped Americans with cheap unbranded products shipped directly from Guangzhou, China. In just seven months, Temu’s app has been downloaded 50 million times.

But the reason that prices on Temu seem impossibly low is that they are. An analysis of the company’s supply chain costs by WIRED—confirmed by a company insider—shows that Temu is losing an average of $30 per order as it throws money at trying to break into the American market. The financial company China Merchants Securities has calculated that Temu, which is also operating in Canada, Australia, and New Zealand, is losing between RMB 4.15 billion and RMB 6.73 billion ($588 million to $954 million) per year. At the same time, the company is squeezing small manufacturers in China, pressuring them to cut prices to levels that make it almost impossible to turn a profit

Re: 美版拼夕夕每单亏损$30,每年亏损十亿美元,

中美大船,相向而行,无可奈何花落去。

夫妻梦碎,卖国求辱,同房丫鬟也将就。

沐猴而冠, 傻不厌诈,搬起石头砸自己脚.

三分像人,七分像鬼,英雄做不了奴才也难当

Re: 美版拼夕夕每单亏损$30,每年亏损十亿美元,

一年亏十亿不算啥。记得uber有次财报,一个季度亏50多亿。一年十亿是小巫见大巫。何况十亿是个高估的数字,原文说的是$588 to $954 million。

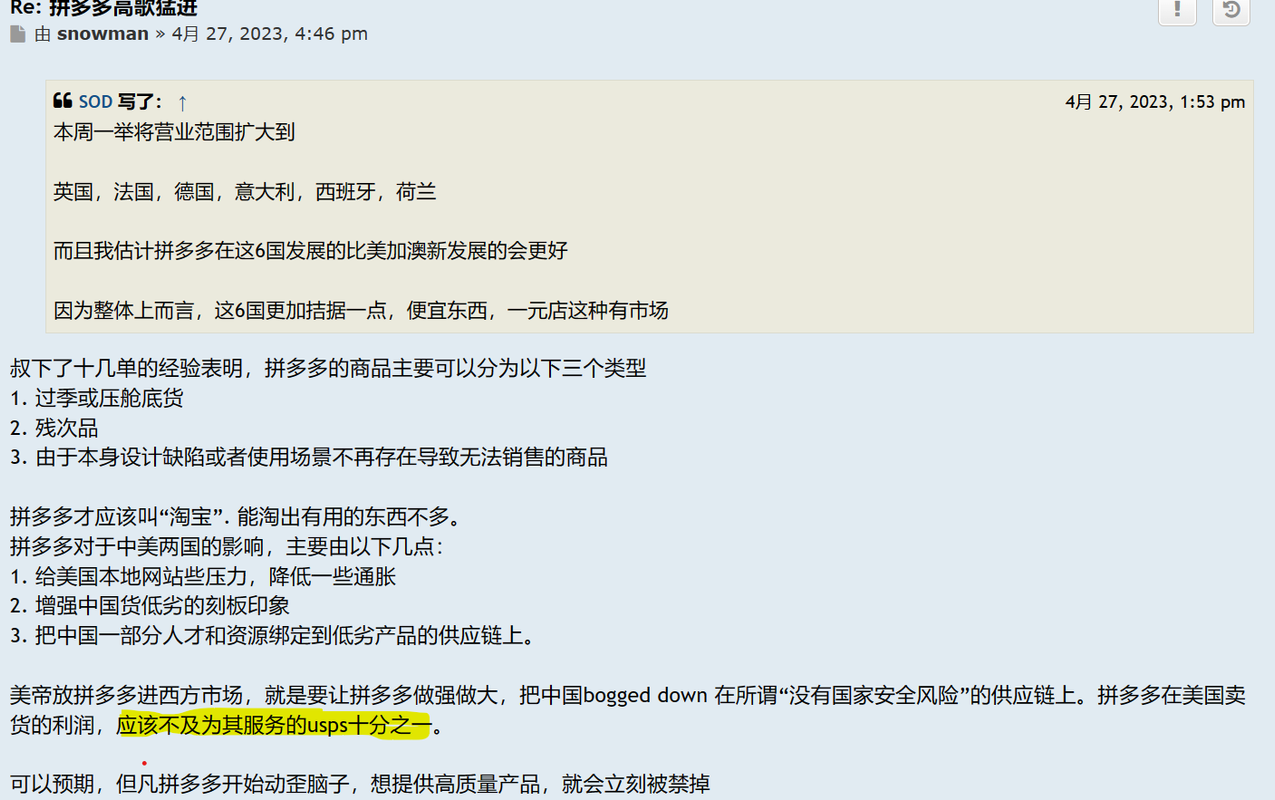

每单亏损30刀也很夸张。至少叔下过的单不会亏这么多。

每单亏损30刀也很夸张。至少叔下过的单不会亏这么多。