Cybertruck一年贬值34%

版主: kazaawang, wh

#1 Cybertruck一年贬值34%

Tesla sold a brand-new 2024 Cybertruck AWD Foundation Series for $100,000. Now, with only 6,000 miles on the odometer, Tesla is offering $65,400 for it – 34.6% depreciation in just a year.

https://electrek.co/2025/05/18/tesla-st ... reciation/

https://electrek.co/2025/05/18/tesla-st ... reciation/

+2.00 积分 [版主 wh 发放的奖励]

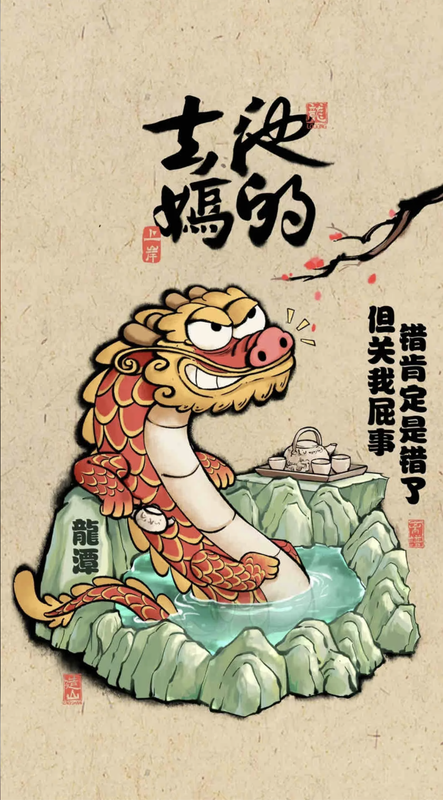

#5 Re: Cybertruck一年贬值34%

mlgb,老子头一次看到有按照一个trade in value算贬值的

YouHi 写了: 2025年 5月 18日 16:15 Tesla sold a brand-new 2024 Cybertruck AWD Foundation Series for $100,000. Now, with only 6,000 miles on the odometer, Tesla is offering $65,400 for it – 34.6% depreciation in just a year.

https://electrek.co/2025/05/18/tesla-st ... reciation/

x1

If printing money would end poverty, printing diplomas would end stupidity.

#8 Re: Cybertruck一年贬值34%

你去买个顶配新款f250,一年以后也能亏34%

YouHi 写了: 2025年 5月 18日 16:46 Pickup trucks generally lose about 20% of their value after a year and 34% after about 3-4 years.

If printing money would end poverty, printing diplomas would end stupidity.

#9 Re: Cybertruck一年贬值34%

F-150好像是3年33%

Grok:

The annual depreciation rate for a Ford F-150 varies depending on the model year, trim, condition, mileage, and market factors. Based on available data:

• General Estimates:

◦ On average, a new Ford F-150 depreciates about 11% per year over the first five years, though this can range from 8-15% annually depending on the source and specific model.

◦ For example, a 2023 Ford F-150 Super Cab depreciates approximately $4,823 per year over three years, totaling a 33% loss (about 11% annually).

◦ A 2021 Ford F-150 Regular Cab depreciates around $4,905 per year over three years, equating to a 43% total loss (about 14.3% annually).

◦ Some sources estimate a lower five-year depreciation rate of 24% total (about 4.8% annually) for well-maintained F-150s with 12,000 miles per year.

• Model-Specific Trends:

◦ The 2023 model year is noted for strong value retention, with a 57% resale value after three years (83% useful life remaining).

◦ Higher-end trims like the Platinum may depreciate faster (up to 46% in five years, or 9.2% annually) due to lower demand for luxury features in used trucks, while the Raptor holds value better.

◦ The F-150 Lightning (electric model) may see steeper depreciation due to evolving EV technology, with estimates suggesting a $7,500-$15,000 drop in the first year for 2022-2023 models.

• Market Factors:

◦ Full-size pickup trucks like the F-150 generally hold value better than cars, with a five-year depreciation of 41.5% compared to 43.7% for all vehicles.

◦ High interest rates and abundant new inventory can increase depreciation, as seen with 2021-2022 models losing nearly 50% in value with 30,000-75,000 miles.

◦ Used vehicle prices remain elevated post-2020, but depreciation can be mitigated by purchasing 2-4-year-old models, which avoid the steep initial value drop.

Example Calculation:

• A 2025 Ford F-150 with an MSRP of $68,333 (average new price) might lose 26.8% after three years (based on historical data), equating to about $18,313 total or $6,104 per year (roughly 8.9% annually).

Recommendations:

• To minimize depreciation, consider buying a used 2022-2023 F-150, as the initial 20% drop occurs in the first year.

• Maintain the vehicle well and keep mileage around 12,000-13,500 annually to maximize resale value.

• Use tools like CarEdge’s Depreciation Calculator or Kelley Blue Book for precise estimates based on your specific trim and mileage.

Note: Depreciation is not guaranteed and varies with market conditions, vehicle condition, and regional demand. For a tailored estimate, provide the specific model year, trim, and mileage, or check tools like those at caredge.com or kbb.com.

Grok:

The annual depreciation rate for a Ford F-150 varies depending on the model year, trim, condition, mileage, and market factors. Based on available data:

• General Estimates:

◦ On average, a new Ford F-150 depreciates about 11% per year over the first five years, though this can range from 8-15% annually depending on the source and specific model.

◦ For example, a 2023 Ford F-150 Super Cab depreciates approximately $4,823 per year over three years, totaling a 33% loss (about 11% annually).

◦ A 2021 Ford F-150 Regular Cab depreciates around $4,905 per year over three years, equating to a 43% total loss (about 14.3% annually).

◦ Some sources estimate a lower five-year depreciation rate of 24% total (about 4.8% annually) for well-maintained F-150s with 12,000 miles per year.

• Model-Specific Trends:

◦ The 2023 model year is noted for strong value retention, with a 57% resale value after three years (83% useful life remaining).

◦ Higher-end trims like the Platinum may depreciate faster (up to 46% in five years, or 9.2% annually) due to lower demand for luxury features in used trucks, while the Raptor holds value better.

◦ The F-150 Lightning (electric model) may see steeper depreciation due to evolving EV technology, with estimates suggesting a $7,500-$15,000 drop in the first year for 2022-2023 models.

• Market Factors:

◦ Full-size pickup trucks like the F-150 generally hold value better than cars, with a five-year depreciation of 41.5% compared to 43.7% for all vehicles.

◦ High interest rates and abundant new inventory can increase depreciation, as seen with 2021-2022 models losing nearly 50% in value with 30,000-75,000 miles.

◦ Used vehicle prices remain elevated post-2020, but depreciation can be mitigated by purchasing 2-4-year-old models, which avoid the steep initial value drop.

Example Calculation:

• A 2025 Ford F-150 with an MSRP of $68,333 (average new price) might lose 26.8% after three years (based on historical data), equating to about $18,313 total or $6,104 per year (roughly 8.9% annually).

Recommendations:

• To minimize depreciation, consider buying a used 2022-2023 F-150, as the initial 20% drop occurs in the first year.

• Maintain the vehicle well and keep mileage around 12,000-13,500 annually to maximize resale value.

• Use tools like CarEdge’s Depreciation Calculator or Kelley Blue Book for precise estimates based on your specific trim and mileage.

Note: Depreciation is not guaranteed and varies with market conditions, vehicle condition, and regional demand. For a tailored estimate, provide the specific model year, trim, and mileage, or check tools like those at caredge.com or kbb.com.

#10 Re: Cybertruck一年贬值34%

你把老领导脸都扇肿了。mmking 写了: 2025年 5月 18日 16:50 F-150好像是3年33%

Grok:

The annual depreciation rate for a Ford F-150 varies depending on the model year, trim, condition, mileage, and market factors. Based on available data:

• General Estimates:

◦ On average, a new Ford F-150 depreciates about 11% per year over the first five years, though this can range from 8-15% annually depending on the source and specific model.

◦ For example, a 2023 Ford F-150 Super Cab depreciates approximately $4,823 per year over three years, totaling a 33% loss (about 11% annually).

◦ A 2021 Ford F-150 Regular Cab depreciates around $4,905 per year over three years, equating to a 43% total loss (about 14.3% annually).

◦ Some sources estimate a lower five-year depreciation rate of 24% total (about 4.8% annually) for well-maintained F-150s with 12,000 miles per year.

• Model-Specific Trends:

◦ The 2023 model year is noted for strong value retention, with a 57% resale value after three years (83% useful life remaining).

◦ Higher-end trims like the Platinum may depreciate faster (up to 46% in five years, or 9.2% annually) due to lower demand for luxury features in used trucks, while the Raptor holds value better.

◦ The F-150 Lightning (electric model) may see steeper depreciation due to evolving EV technology, with estimates suggesting a $7,500-$15,000 drop in the first year for 2022-2023 models.

• Market Factors:

◦ Full-size pickup trucks like the F-150 generally hold value better than cars, with a five-year depreciation of 41.5% compared to 43.7% for all vehicles.

◦ High interest rates and abundant new inventory can increase depreciation, as seen with 2021-2022 models losing nearly 50% in value with 30,000-75,000 miles.

◦ Used vehicle prices remain elevated post-2020, but depreciation can be mitigated by purchasing 2-4-year-old models, which avoid the steep initial value drop.

Example Calculation:

• A 2025 Ford F-150 with an MSRP of $68,333 (average new price) might lose 26.8% after three years (based on historical data), equating to about $18,313 total or $6,104 per year (roughly 8.9% annually).

Recommendations:

• To minimize depreciation, consider buying a used 2022-2023 F-150, as the initial 20% drop occurs in the first year.

• Maintain the vehicle well and keep mileage around 12,000-13,500 annually to maximize resale value.

• Use tools like CarEdge’s Depreciation Calculator or Kelley Blue Book for precise estimates based on your specific trim and mileage.

Note: Depreciation is not guaranteed and varies with market conditions, vehicle condition, and regional demand. For a tailored estimate, provide the specific model year, trim, and mileage, or check tools like those at caredge.com or kbb.com.

x2

#11 Re: Cybertruck一年贬值34%

Premium F-250比F-150贬值还慢一点,三年29%

The Ford F-250 Super Duty, particularly in premium trims like the Lariat, King Ranch, or Platinum, has a different depreciation profile compared to the F-150 due to its heavy-duty classification, higher initial cost, and specialized market demand. Below are the estimated annual depreciation rates for a premium Ford F-250, focusing on 2025 model year estimates and recent data for similar model years:

Annual Depreciation Rate for Premium Ford F-250 (2025 and Recent Models)

• General Estimates:

◦ A Ford F-250 Super Duty (premium trims) with an average new price of $72,489 (based on 2024 data) is expected to depreciate approximately 28% over 3 years, or about 9.3% annually, assuming good condition and 12,000 miles per year. This translates to a total loss of $20,029 over 3 years, or roughly $6,676 per year.

◦ Over 5 years, the F-250 Super Duty is projected to lose about 40-45% of its value, equating to an annual depreciation rate of 8-9%. This is slightly better than the industry average for pickups (43.7% over 5 years).

◦ Kelley Blue Book data for a 2023 F-250 indicates a 14% depreciation over 3 years (about 4.7% annually), with an average annual loss of $2,267 and a current resale value of $39,162. However, premium trims like Platinum may depreciate faster due to lower demand for luxury features in used heavy-duty trucks.

• Model-Specific Trends:

◦ Premium Trims (Lariat, King Ranch, Platinum): Higher-end trims tend to depreciate faster than base models like the XL or XLT because luxury features are less valued in the used heavy-duty truck market, which prioritizes utility. For instance, a 2022 F-250 Platinum may lose 22% over 3 years (about 7.3% annually, or $3,212 per year), with a resale value of $32,604.

◦ 2022 Model Year: The 2022 F-250 Super Duty is noted as a top value year, retaining 72% of its original value with 83% of useful life remaining, suggesting an annual depreciation rate of about 9.3% over 3 years.

◦ Diesel vs. Gas: Diesel-powered F-250s, common in premium trims, hold value better, especially after 100,000 miles, due to demand in commercial sectors like construction. A diesel F-250 may depreciate 5-10% less over 5 years compared to a gas model.

• Market Factors:

◦ Heavy-duty trucks like the F-250 Super Duty hold value better than cars but slightly worse than half-ton pickups like the F-150 due to their niche market. They rank in the top 25% for depreciation among trucks.

◦ High interest rates and increased new inventory can accelerate depreciation, as seen with 2020 models losing 49% over 3 years (about 16.3% annually, or $7,542 per year).

◦ Premium trims are more sensitive to market conditions, such as high interest rates, which reduce demand for expensive used trucks.

• 2025-Specific Estimate:

◦ For a 2025 Ford F-250 Super Duty in a premium trim (e.g., Platinum, MSRP ~$80,000-$90,000), expect an initial depreciation of 15-20% in the first year (due to the steepest loss when driven off the lot), followed by 7-10% annually for years 2-5. This aligns with a 3-year total loss of 25-30% (approximately $20,000-$27,000, or $6,667-$9,000 per year).

◦ Buying a 2-year-old 2023 F-250 could save $20,029 compared to new, with 83% of useful life remaining.

Factors Influencing Premium F-250 Depreciation

• Condition and Mileage: Vehicles with 12,000-15,000 miles per year and clean titles depreciate slower. High mileage (e.g., 20,000+ miles/year) can increase annual depreciation by 2-5%.

• Trim and Options: Premium trims with extensive luxury options (e.g., leather interiors, advanced tech) lose value faster than utilitarian trims due to lower demand in the used market.

• Market Demand: F-250s are popular for commercial use, and diesel models hold value better in regions with high demand for towing and hauling.

• Economic Conditions: Elevated used vehicle prices since 2020 have slowed depreciation, but softening demand for premium trims in 2025 could increase rates slightly.

Recommendations

• Minimize Depreciation:

◦ Buy a used 2022 or 2023 F-250 Super Duty (2-3 years old) to avoid the initial 15-20% value drop.

◦ Opt for a diesel engine if planning to keep the truck long-term, as it retains value better at higher mileage.

◦ Maintain the vehicle in good condition with regular maintenance and keep mileage around 12,000 miles per year.

• Tools for Precision:

◦ Use CarEdge’s Depreciation Calculator (caredge.com) or Kelley Blue Book (kbb.com) to get tailored estimates for specific trims, mileage, and locations.

◦ Check local market trends, as depreciation varies by region due to demand for heavy-duty trucks.

Notes

• Depreciation estimates are not guarantees and depend on real-time market conditions, vehicle condition, and regional factors. For a precise estimate, provide the exact trim (e.g., Platinum, King Ranch), mileage, and location, or use online tools like those mentioned.

• The F-250 Super Duty’s premium trims depreciate slightly faster than the F-150’s premium trims due to their higher initial cost and niche market, but they still perform well compared to other vehicle classes.

If you have additional details (e.g., specific trim, intended ownership period), I can refine the estimate further!

The Ford F-250 Super Duty, particularly in premium trims like the Lariat, King Ranch, or Platinum, has a different depreciation profile compared to the F-150 due to its heavy-duty classification, higher initial cost, and specialized market demand. Below are the estimated annual depreciation rates for a premium Ford F-250, focusing on 2025 model year estimates and recent data for similar model years:

Annual Depreciation Rate for Premium Ford F-250 (2025 and Recent Models)

• General Estimates:

◦ A Ford F-250 Super Duty (premium trims) with an average new price of $72,489 (based on 2024 data) is expected to depreciate approximately 28% over 3 years, or about 9.3% annually, assuming good condition and 12,000 miles per year. This translates to a total loss of $20,029 over 3 years, or roughly $6,676 per year.

◦ Over 5 years, the F-250 Super Duty is projected to lose about 40-45% of its value, equating to an annual depreciation rate of 8-9%. This is slightly better than the industry average for pickups (43.7% over 5 years).

◦ Kelley Blue Book data for a 2023 F-250 indicates a 14% depreciation over 3 years (about 4.7% annually), with an average annual loss of $2,267 and a current resale value of $39,162. However, premium trims like Platinum may depreciate faster due to lower demand for luxury features in used heavy-duty trucks.

• Model-Specific Trends:

◦ Premium Trims (Lariat, King Ranch, Platinum): Higher-end trims tend to depreciate faster than base models like the XL or XLT because luxury features are less valued in the used heavy-duty truck market, which prioritizes utility. For instance, a 2022 F-250 Platinum may lose 22% over 3 years (about 7.3% annually, or $3,212 per year), with a resale value of $32,604.

◦ 2022 Model Year: The 2022 F-250 Super Duty is noted as a top value year, retaining 72% of its original value with 83% of useful life remaining, suggesting an annual depreciation rate of about 9.3% over 3 years.

◦ Diesel vs. Gas: Diesel-powered F-250s, common in premium trims, hold value better, especially after 100,000 miles, due to demand in commercial sectors like construction. A diesel F-250 may depreciate 5-10% less over 5 years compared to a gas model.

• Market Factors:

◦ Heavy-duty trucks like the F-250 Super Duty hold value better than cars but slightly worse than half-ton pickups like the F-150 due to their niche market. They rank in the top 25% for depreciation among trucks.

◦ High interest rates and increased new inventory can accelerate depreciation, as seen with 2020 models losing 49% over 3 years (about 16.3% annually, or $7,542 per year).

◦ Premium trims are more sensitive to market conditions, such as high interest rates, which reduce demand for expensive used trucks.

• 2025-Specific Estimate:

◦ For a 2025 Ford F-250 Super Duty in a premium trim (e.g., Platinum, MSRP ~$80,000-$90,000), expect an initial depreciation of 15-20% in the first year (due to the steepest loss when driven off the lot), followed by 7-10% annually for years 2-5. This aligns with a 3-year total loss of 25-30% (approximately $20,000-$27,000, or $6,667-$9,000 per year).

◦ Buying a 2-year-old 2023 F-250 could save $20,029 compared to new, with 83% of useful life remaining.

Factors Influencing Premium F-250 Depreciation

• Condition and Mileage: Vehicles with 12,000-15,000 miles per year and clean titles depreciate slower. High mileage (e.g., 20,000+ miles/year) can increase annual depreciation by 2-5%.

• Trim and Options: Premium trims with extensive luxury options (e.g., leather interiors, advanced tech) lose value faster than utilitarian trims due to lower demand in the used market.

• Market Demand: F-250s are popular for commercial use, and diesel models hold value better in regions with high demand for towing and hauling.

• Economic Conditions: Elevated used vehicle prices since 2020 have slowed depreciation, but softening demand for premium trims in 2025 could increase rates slightly.

Recommendations

• Minimize Depreciation:

◦ Buy a used 2022 or 2023 F-250 Super Duty (2-3 years old) to avoid the initial 15-20% value drop.

◦ Opt for a diesel engine if planning to keep the truck long-term, as it retains value better at higher mileage.

◦ Maintain the vehicle in good condition with regular maintenance and keep mileage around 12,000 miles per year.

• Tools for Precision:

◦ Use CarEdge’s Depreciation Calculator (caredge.com) or Kelley Blue Book (kbb.com) to get tailored estimates for specific trims, mileage, and locations.

◦ Check local market trends, as depreciation varies by region due to demand for heavy-duty trucks.

Notes

• Depreciation estimates are not guarantees and depend on real-time market conditions, vehicle condition, and regional factors. For a precise estimate, provide the exact trim (e.g., Platinum, King Ranch), mileage, and location, or use online tools like those mentioned.

• The F-250 Super Duty’s premium trims depreciate slightly faster than the F-150’s premium trims due to their higher initial cost and niche market, but they still perform well compared to other vehicle classes.

If you have additional details (e.g., specific trim, intended ownership period), I can refine the estimate further!

上次由 mmking 在 2025年 5月 18日 16:52 修改。

#12 Re: Cybertruck一年贬值34%

抢手的车没折扣,甚至要加价。YouHi 写了: 2025年 5月 18日 16:46 Pickup trucks generally lose about 20% of their value after a year and 34% after about 3-4 years.

如果你买车的时候就20%折扣,一年后就算损失20%,也相当于那车总共贬值了40%

#13 Re: Cybertruck一年贬值34%

价格辣么高的基本只能trade-in, private party一般很少有人拿得出,而且不trade-in买下一辆会很难,钱不够。

高度怀疑老领导肉身在东大。。。

#14 Re: Cybertruck一年贬值34%

您错了,特斯拉说了,cybertruck 出门就不要再回来了,特斯拉不接受Cybertruck trade in

这部车怎么回到特斯拉手上的不太清楚,或许是lemon law不得不回购

#15 Re: Cybertruck一年贬值34%

lemon law是什么?wildvoices 写了: 2025年 5月 18日 16:59 您错了,特斯拉说了,cybertruck 出门就不要再回来了,特斯拉不接受Cybertruck trade in

这部车怎么回到特斯拉手上的不太清楚,或许是lemon law不得不回购

年轻人开tesla的好像不少,前几天去我们这里的一个新小区,看到不少车库停着tesla。

上次由 wh 在 2025年 5月 18日 17:26 修改。

原因: 未提供修改原因

原因: 未提供修改原因

-

VladPutin(清风不识字何故乱翻书)

- 论坛元老

VladPutin 的博客 - 帖子互动: 1673

- 帖子: 14313

- 注册时间: 2022年 7月 24日 11:12

#18 Re: Cybertruck一年贬值34%

太保值了,粉儿快充。

蒙古国有愚豕浮阳外越,便结不通,频下清个痢虚之气。虽屡试开赛露之剂,终无寸效。遂引诣兽医师诊之。医者摩其腹良久,谓主人曰:"咄!此蠢物腹中空若悬磬,纵投万斛通肠开赛之剂,犹决涸泽而求鲋也,岂有济哉?"

#19 Re: Cybertruck一年贬值34%

Telsa has changed the policy, now they accepted CT trade in

wildvoices 写了: 2025年 5月 18日 16:59 您错了,特斯拉说了,cybertruck 出门就不要再回来了,特斯拉不接受Cybertruck trade in

这部车怎么回到特斯拉手上的不太清楚,或许是lemon law不得不回购

#20 Re: Cybertruck一年贬值34%

新政策是兜底行为,大概特斯拉不接受trade-in的话,市场就更要崩了。

相同的CT, 二手车网站Carvana只给54000,特斯拉给了65000+, 特粉车主感激涕零。。。

相同的CT, 二手车网站Carvana只给54000,特斯拉给了65000+, 特粉车主感激涕零。。。

x1

x1

x1

x1

x1